Lahti is well-positioned to become a tourist hotspot. It has the right location, events, and a strong sustainability profile, all of which should be translated into more overnight visitors. However, evidence suggests that Lahti has been unsuccessful in attracting new investment for hotel accommodations in the post-COVID era.

Investors often do not seek comprehensive feasibility studies at their initial contact; instead, they require a concise evidence pack and a clear path forward. Dissanayaka (2025) aimed to translate this insight into a practical, low-cost operating framework that Visit Lahti and other stakeholders can use when pitching to potential investors.

Investor decision-making process

Early decisions made by investors are influenced by three key factors. First, a named Single Point of Contact (SPOC). Secondly, a compact and comparable site package that includes forward demand signals, class-matched comparisons, and indicative ranges for ADR/RevPAR/occupancy, and third, a one-page approval path that outlines clear steps, expected timelines, and key contact roles. (Keloneva 2022; Kaha 2024.)

Sustainability claims are more effective if accompanied by site-level evidence, such as available district energy options, mobility initiatives, low-carbon building approaches, and certification intentions. A light operator signal can enhance credibility in some cases. (Ovchinnikova 2023.)

A comparative analysis and stakeholder-interview-based framework

The study began with a public overview of Lahti and its investment ecosystem. It was followed by a benchmarking analysis of three equally sized Finnish destinations to understand what strategies have been effective for them, how contacts are accessible, how the approval process is explained, and whether sustainability initiatives are showcased at the site level. (Dissanayaka 2025.)

Based on the comparative study Dissanayaka (2025) conducted semi-structured interviews with local stakeholders and analyzed the data through reflexive thematic analysis to identify patterns. A draft framework was subsequently developed and validated through second-round interviews with participants with a background in the hospitality sector investment.

Benchmarking revealed that Finnish counterparts who make their outreach and progress visible significantly reduce uncertainty for investors. Lahti can enhance its strategy by standardizing the site and evidence packages. Evidence packages should include events and anchor projects with the most appropriate sites and concepts, such as lifestyle hotels, aparthotels, and long-stay accommodations. (Dissanayaka 2025.)

The framework is designed to utilize existing resources effectively. There is no requirement for a new structure; rather, the focus is on establishing clearer ownership and improving the presentation of information that is already accessible. (Dissanayaka 2025.)

Streamlined investor journey

The framework introduces a visible Single Point of Contact (SPOC) hosted by the regional development team, which aims to acknowledge inquiries within 48 hours while logging each lead. Evidence annexes that include demand insights, class-matched comparisons with indicative ranges, sustainability topics, and the approval path were also clarified. (Dissanayaka 2025.)

Investors will receive a well-organized package with a name and contact number, enabling prompt scheduling of meetings. Discussions will evolve from overarching macro-level topics to specific details regarding Lahti and the site itself.

The approvals pathway will outline subsequent steps and identify the decision-makers responsible for each stage. If a site meets the criteria, introductions to operators and an initial memorandum will be arranged. Conversely, if the site is deemed unsuitable, the log and KPIs will still offer valuable insights by highlighting areas for improvement.

Authors

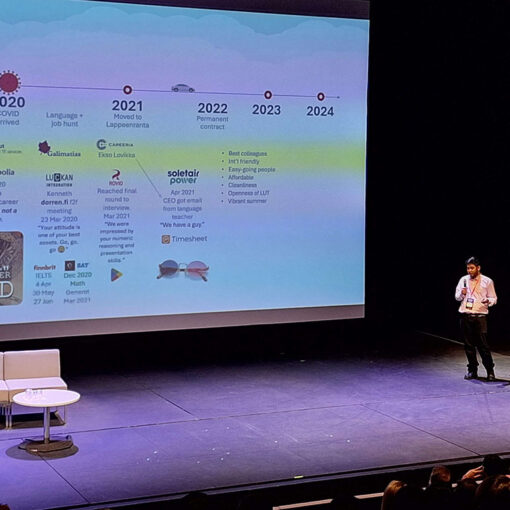

Pasan Dissanayaka is a graduating student of International Business and Administration at LAB University of Applied Sciences.

Taina Savonen works as a Senior Lecturer at LAB University of Applied Sciences and is interested in regional development possibilities.

References

Dissanayaka, P. 2025. Targeted investment framework for attracting hotel investors to Lahti: Developed with stakeholder interviews and mini-benchmarks for Visit Lahti. Bachelor’s thesis. LAB University of Applied Sciences. Cited 9 Dec 2025. Available at https://www.theseus.fi/bitstream/handle/10024/905211/Dissanayaka_Pasan.pdf?sequence=2&isAllowed=y

Kaha, A. 2024. Leveraging digital tools for enhancing investment promotion in small OECD economies. Bachelor’s thesis. Haaga-Helia University of Applied Sciences. Cited 2 Dec 2025. Available at https://www.theseus.fi/handle/10024/850263

Keloneva, E. 2022. How can a municipality support companies’ investment decisions? Case: Rajakangas. Bachelor’s thesis. Lapland University of Applied Sciences. Cited 2 Dec 2025. Available at https://www.theseus.fi/handle/10024/786346

Ovchinnikova, A. 2023. Analysis of regenerative practices in the hotel industry in Finland. Bachelor’s thesis. Haaga-Helia University of Applied Sciences. Cited 15 Oct 2025. Available at https://www.theseus.fi/handle/10024/811108/

TheInvestorPost. 2020. Rahoittaa, osakekauppa, päivän kauppa. Pixabay. Cited 9 Dec 2025. Available at https://pixabay.com/fi/photos/rahoittaa-osakekauppa-p%C3%A4iv%C3%A4n-kauppa-5771541/